missoula property tax increase

Missoulas problems are even worse when compared to property tax increases nationally which increased at an average rate of 32 between 2016 and 2020. MIssoula County Grants Community Programs.

Property Taxes Missoula County Blog

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

. Residents inside the city will see no tax increases resulting from the countys budget. Arapahoe County has one of the highest median property taxes in the United States and is ranked 738th of the 3143 counties in order of median property taxes. In fact if you took that homes property taxes in 2016 and applied the national average property tax increase.

Add in a personal property tax rate of 016 percent and that brings up the total cost to 19045. Senator Luetkemeyers proposals build on legislation he sponsored and passed in 2020 to reign in runaway increases in property tax assessments. Missoula property tax increase Friday March 11 2022 Edit.

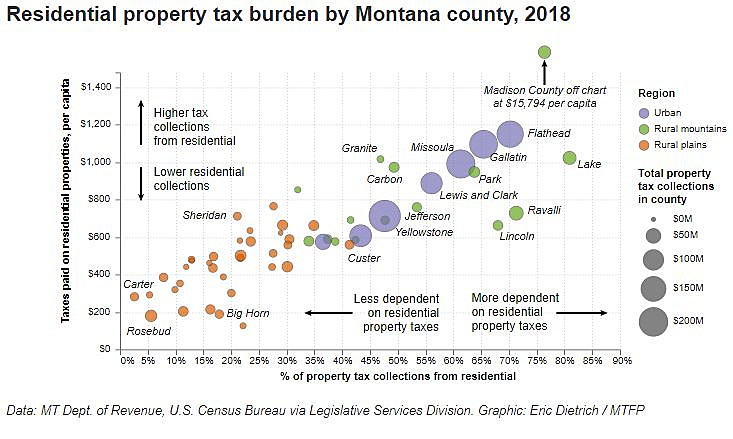

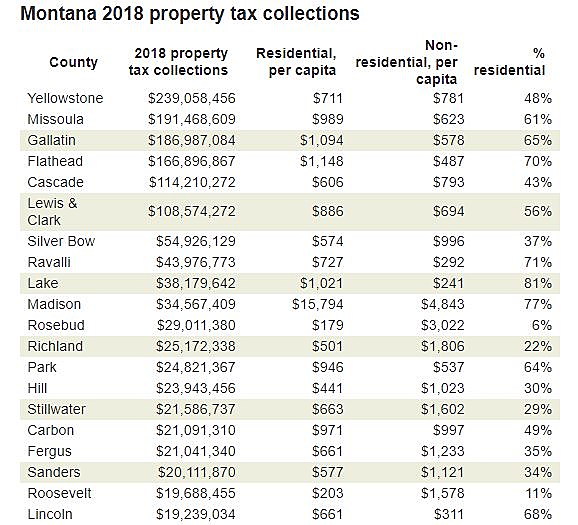

Missoula City-County Health Department. The value of your property directly affects the property taxes you pay to schools Missoula County and the City of Missoula. Missoula County has one of the highest median property taxes in the United States and is ranked 374th of the 3143 counties.

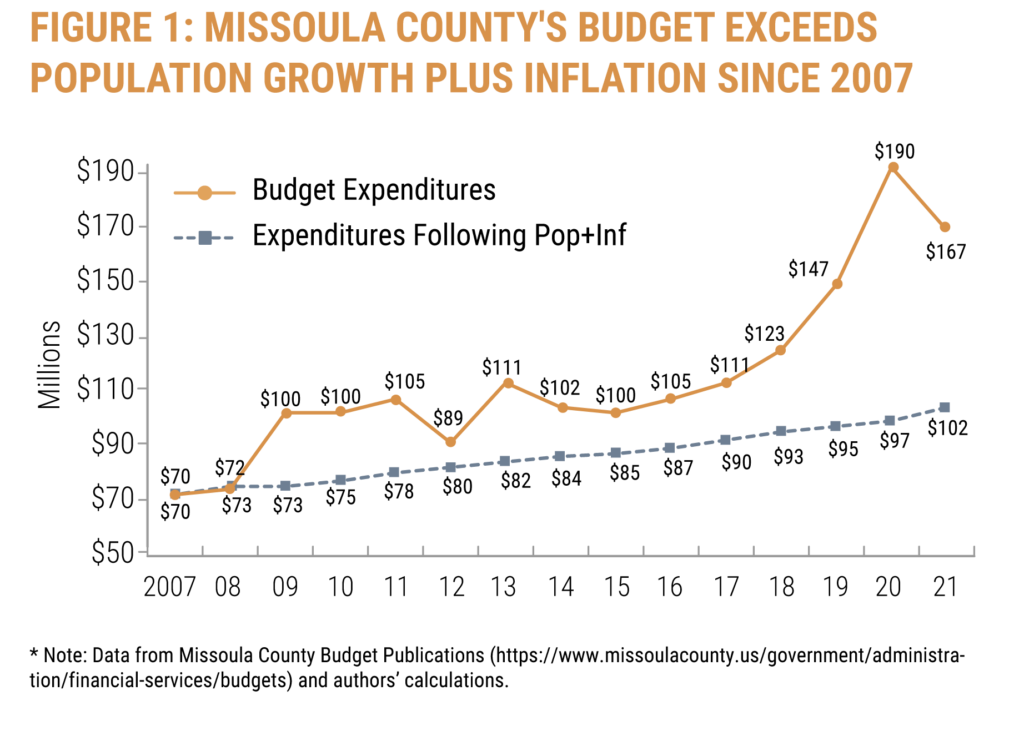

Missoula county is proposing an 8 percent increase in property taxes to balance its new annual budget and its also calling on the state to fix what commissioners have deemed a broken tax system. Combined with a handful of new additions and investments the overall tax increase comes to 38 million. The accuracy of this data is not guaranteed.

Its unfortunately caused a sharp rise in property taxes as well said Missoula realtor Brint Wahlberg. MISSOULA With a few subtle changes Missoula County on Thursday adopted its Fiscal Year 22 budget one that maintains basic services and will increase property taxes slightly to cover health. 093 of home value.

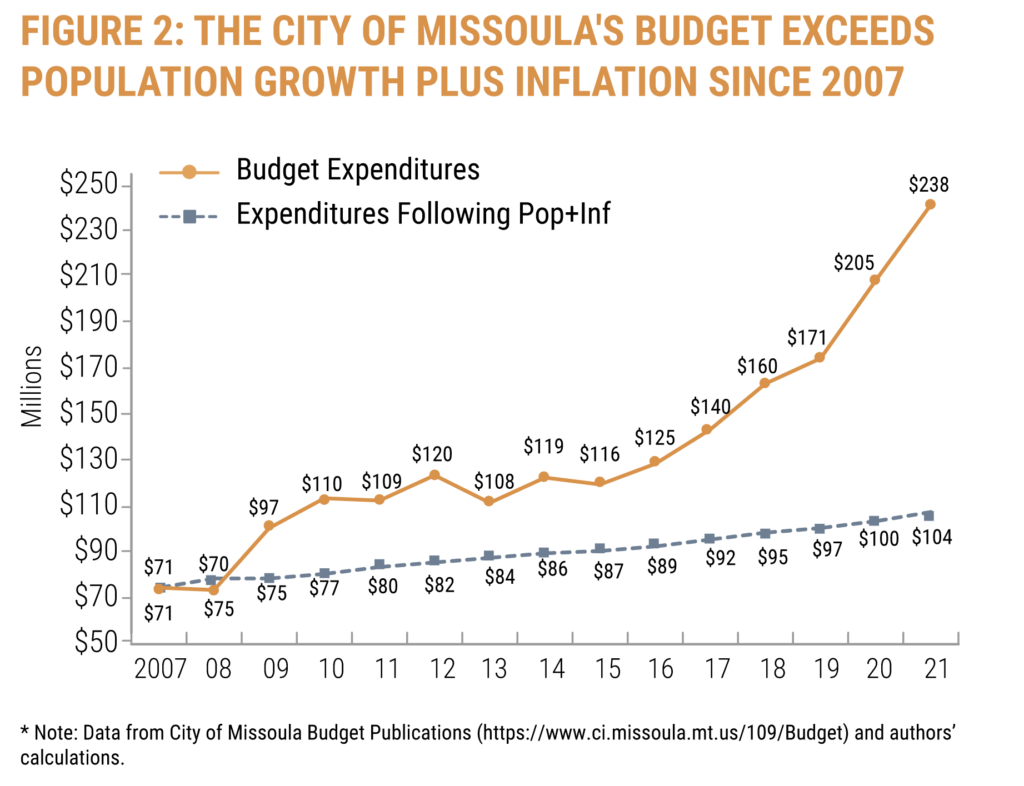

Missoula County Animal Control. The county is set to. Missoula mayor proposes property tax hike to pay for 385 percent increase in city spending.

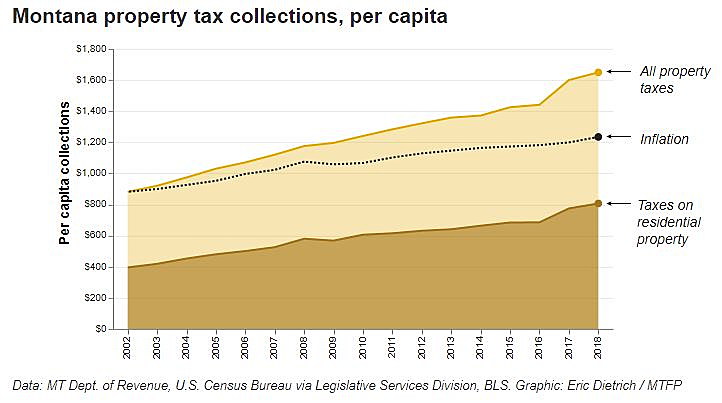

The report found that the average yearly increase in each homes property taxes from 2016 to 2020 were 74 8 and 65. The Department of Revenue a division of the State of Montanas government determines the market value of residential and commercial property once every two years. The notices for the 2019-2020 appraisal cycle are.

Missoula County has one of the highest median property taxes in the United. Thats more than double the rate of the house with the smallest increase in our analysis house three. The Missoula City Council has approved a measure to boost its fees for parks and the services it provides to the specific groups who use the citys facilities.

Yearly median tax in Missoula County. Mt dor reappraisal average missoula county home 15 assessed value increase to 350000 for fiscal year 2022 140 increase in county portion of property taxes. By Martin Kidston August 30 2019.

Two years ago property owners in my district and elsewhere in Missouri were blindsided. The Missoula County Board of Commissioners adopted Tuesday the countys budget for the 2021 fiscal year which includes a slight increase to property taxes to fund costs and programs relating to. Missoula County collects on average 093 of a propertys assessed fair market value as property tax.

Missoula County Community and Planning Services. Property Tax data was last updated 04072022 0700 PM. The median property tax in Arapahoe County Colorado is 1546 per year for a home worth the median value of 232300.

Missoula County Detention Center. Missoula County Administration Building. The median property tax in Missoula County Montana is 2176 per year for a home worth the median value of 233700.

You are visitor 4958670. Missoula property tax increase Monday May 30 2022 Edit The county is proposing a budgetary increase of 64 percent in Fiscal Year 2020 including a 52 percent increase in personnel costs and a 62 percent increase in operations. 4 from last year and the property tax revenue will increase by 8.

Palm Beach County collects on average 102 of a propertys assessed fair market value as property tax. Missoula County commissioners just approved the 2020 budget. The county reviewed over 100 new requests for funding this year said Henthorne.

The total budget is increasing by 6. Ad Find Out the Market Value of Any Property and Past Sale Prices. The Missoula County Board of Commissioners adopted Tuesday the countys budget for the 2021 fiscal year which includes a slight increase to property taxes to fund costs and programs relating to equity affordable housing criminal justice reform and sustainability.

Missoula County is proposing an 8 percent increase in property taxes to balance its new annual budget and its also calling on the state to fix what commissioners have deemed a broken tax system. County Services City of Missoula home 0 overall increase for county services andvoter-approved bonds Missoula County home 1021 increase for county services and voter-approved bonds. Both new measures were pre-filed for consideration during the 2021 legislative session which begins Jan.

The median property tax in Missoula County Montana is 2176 per year for a home worth the median value of 233700. Property Tax data was last updated 06242022 0600 PM. Average Missoula County home 15 assessed value increase to 350000 for fiscal year 2022 140 increase in county portion of property taxes.

Outside the reappraisal costs the budget adopted by the county will increase property taxes by 1021 for a 350000 home outside city limits. Outside the reappraisal costs the budget adopted by the county will increase property taxes by 1021 for a 350000 home outside city limits. 1 weather alerts 1 closingsdelays 1 weather alerts 1.

He said most homeowners saw a 15 to 20-percent increase. While it may seem small a few. This fiscal year 2020 final.

Yearly median tax in Missoula County. The median home sales price increase that Missoula saw in 2021 was the largest of any single year on record going back multiple decades. The median property tax in Winnebago County Illinois is 3056 per year for a home worth the median value of 128100.

Missoula County Courthouse Annex. Missoula County collects on average 093 of a propertys assessed fair market value as property tax. These increases are considerably higher than Montanas average yearly property tax increase of 5 and drastically higher than the national yearly property tax increase average of roughly 32.

Property Taxes Missoula County Blog

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

New Policy Brief The Real Missoula Budget

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Property Taxes Missoula County Blog

Property Taxes Missoula County Blog

Proposed 2022 Initiative Would Cap Montana Property Taxes Assessment Values Missoula Current

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Missoula County Adopts Fy22 Budget State Reappraisals Lead To Property Tax Increase Missoula Current

Missoula City And County Legislature Failed To Provide Meaningful Property Tax Relief Missoula Current

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Missoula Is Up To Its Eyeballs In Debt

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Property Taxes Missoula County Blog

Property Taxes Missoula County Blog

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current